bsenc.ru

Market

Texting And Driving Accidents

Cell phone use while driving statistics and texting and driving facts show that this behavior is common and dangerous for teen drivers. This might involve scenarios where the driver was speeding excessively, navigating traffic unsafely, or ignoring traffic signals while texting. For example. The total number of fatal distracted driving crashes decreased 6% in to This might involve scenarios where the driver was speeding excessively, navigating traffic unsafely, or ignoring traffic signals while texting. For example. Although texting while driving is not illegal, a driver who causes an accident because he or she was texting instead of watching the road may be held liable for. As a form of distracted driving, texting while driving significantly increases the chances that a driver will be involved in a motor vehicle accident. Texting. Distracted driving continues to be a problem in Texas and takes many forms. In , nearly one in six crashes on Texas roads were caused by a distracted. If a driver was texting and driving or engaging in some other unlawful cell phone use when behind the wheel and they caused a car accident, and another person. In a survey of high school drivers, the CDC found that 39% of the students admitted to texting or emailing while driving. And texting while driving is more. Cell phone use while driving statistics and texting and driving facts show that this behavior is common and dangerous for teen drivers. This might involve scenarios where the driver was speeding excessively, navigating traffic unsafely, or ignoring traffic signals while texting. For example. The total number of fatal distracted driving crashes decreased 6% in to This might involve scenarios where the driver was speeding excessively, navigating traffic unsafely, or ignoring traffic signals while texting. For example. Although texting while driving is not illegal, a driver who causes an accident because he or she was texting instead of watching the road may be held liable for. As a form of distracted driving, texting while driving significantly increases the chances that a driver will be involved in a motor vehicle accident. Texting. Distracted driving continues to be a problem in Texas and takes many forms. In , nearly one in six crashes on Texas roads were caused by a distracted. If a driver was texting and driving or engaging in some other unlawful cell phone use when behind the wheel and they caused a car accident, and another person. In a survey of high school drivers, the CDC found that 39% of the students admitted to texting or emailing while driving. And texting while driving is more.

While you are 23 times more likely to crash your car while texting than not, and this statistic is 6 times greater than the likelihood of crashing after. Texting while driving has been against the law in Texas since Violators face a fine of $25 to $99 for a first offense and up to $ for subsequent. 18% of all fatal accidents are caused by driver distractions. Reading text messages on a cell phone while driving involves visual, manual, and mental. The Dangerous Truth about Texting and Driving · Overall, 1 in 4 car accidents are caused by texting and driving. · At any given time throughout the day. Texting and driving increase the likelihood of an accident by 23 times. 77% of adults and 55% of teen drivers think they can manage to text while. Cell Phone Distractions Each year over accidents caused by texting while driving lead to severe injuries. Driving and cell phone conversations both. tracted drivers and 15 percent of drivers distracted by cell phones in fatal crashes admit to a negative behavior such as texting while driving might be small. According to a study conducted by the Virginia Tech Transportation Institute (VTTI), texting on a cell phone increases the risk of an accident or a near-crash. A texting driver is 23 times more likely to be involved in a car crash than a non-texting driver, according to Drive Safe Alabama. Drivers who text while. Distracted driving across states: The risks vary across the U.S. New Mexico had the highest rate of fatal car accidents due to distracted driving in , with. Texting, which includes messaging, is considered the most dangerous type of distracted driving because it combines visual, manual and cognitive distraction. Distracted Driving · SC averages 2 crashes every hour with a distracted driver. · You will travel the length of a football field in the time it take you to · You. According to the CDC, approximately 9 people are killed and more than 1, are injured in distracted driving-related crashes every day in the U.S. According to the CDC, approximately 9 people are killed and more than 1, are injured in distracted driving-related crashes every day in the U.S. Drivers who talk on their smartphones are 4 times more likely to crash (the same odds as drunk drivers) and drivers who text while driving are 8 times more. These car accident statistics include distracted driving accidents with injuries and 11 crashes with traffic fatalities. South Carolina motorists also face. Using a cellphone while driving increases crash risk. · Cellphones and texting aren't the only things that can distract drivers. · Laws restricting phone use by. Demonstrating negligence after a texting while driving accident requires showing a breached duty of care that directly caused injuries. As a form of negligence. Can Texting and Driving Accident Victims File a Claim in Columbia? If you are the victim of a Columbia texting and driving car crash, you're entitled to. According to a study conducted by the Virginia Tech Transportation Institute (VTTI), texting on a cell phone increases the risk of an accident or a near-crash.

Interest Earning Calculator For Savings

Realize the power of saving and investing with the TD Compound Interest Calculator and discover how your investments could grow over time. A high interest savings calculator will help you plan your savings deposits and allow you to see how much you'll earn throughout a specific period of time. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. Our compound interest calculator shows you how compound interest can increase your savings Annual interest rate: (max 20%) Effective interest rate: %. Free calculator to find out the balance and interest of a savings account while accounting for tax, periodic contributions, compounding frequency. Even a small difference in the interest you are paid on your savings can add up over time. The annual rate of return for each savings account. The. Calculate your savings growth with ease using our Compound Interest Calculator. How do you calculate interest on a savings account? A savings account has an Annual Percentage Yield (APY), which reflects your account's current interest rate. Need to save for a major purchase? Calculate the amount you need to save to reach your goal, and get tips on how to grow your savings faster. Realize the power of saving and investing with the TD Compound Interest Calculator and discover how your investments could grow over time. A high interest savings calculator will help you plan your savings deposits and allow you to see how much you'll earn throughout a specific period of time. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. Our compound interest calculator shows you how compound interest can increase your savings Annual interest rate: (max 20%) Effective interest rate: %. Free calculator to find out the balance and interest of a savings account while accounting for tax, periodic contributions, compounding frequency. Even a small difference in the interest you are paid on your savings can add up over time. The annual rate of return for each savings account. The. Calculate your savings growth with ease using our Compound Interest Calculator. How do you calculate interest on a savings account? A savings account has an Annual Percentage Yield (APY), which reflects your account's current interest rate. Need to save for a major purchase? Calculate the amount you need to save to reach your goal, and get tips on how to grow your savings faster.

Calculate Annual Percentage Yield using our APY Interest Calculator. Learn Low fees and high earnings aren't just for savings. Our line of checking. Length of time, in years, that you plan to save. Step 4: Interest Rate. Estimated Interest Rate. Your estimated annual interest rate. Retirement and Savings Calculators. TFSA Calculator. See how fast your GIC Interest Rates · RRSP Calculator · TFSA Calculator. Newsletters. Investment. Results vary from the actual interest earned on Westpac products due to differences in the calculation methods used. Interest rates may change. You can calculate the simple interest rate by taking the initial deposit or principal, multiplying by the annual rate of interest and multiplying it by time. You can calculate the amount of simple interest your account earns by multiplying the account balance by the interest rate for a select time period. To. Interest Rate: % p.a.. Savings Term: 3 Yrs. Results. Final Balance: $41, Amount Deposited: $41, Interest Earned: $ File Format. Pdf. Savings accounts are a great way to reach your savings goals. Use this calculator to find out how much interest you can earn. Member FDIC. Simple interest — If your account has a simple interest rate, you'll earn interest only on the cash you deposit. Compound interest — With a savings account that. Then, click the "calculate" button to see how your savings add up! For more Because interest and tax rates can't be predicted, these calculators. Interest Earning Calculator. Amount to be invested: $. Current interest rate, %, View interest rates. Length of term: days OR, years. Clear. * Please note. Free compound interest calculator to find the interest, final balance, and schedule using either a fixed initial investment and/or periodic contributions. Interest Earning Calculator. Amount to be invested: $. Current interest rate, %, View interest rates. Length of term: days OR, years. Clear. * Please note. Understanding interest rates and how much interest you're earning can be a confusing task. Utilize our Ally savings interest calculator to make it all add. Find out how much interest you can earn by frequently depositing your money in a People's Choice savings account or term investment. A CD (certificate of deposit) can earn %, or even higher, depending on the length and financial institution. How does compound interest work? Compound. Calculate your potential savings with ICICI Bank Savings Account Interest Rate Calculator. Find out how much you could earn in your interest. Try it now! For a high yield savings account, on the other hand, it's not uncommon to see interest rates of %%. A CD (certificate of deposit) can earn %, or. A savings account interest rate calculator is a quick-and-easy tool that helps you figure out the interest you can earn monthly on your savings account balance. Annual rate of return is the increase in your investment over a year, as a proportion of your original investment. View TD Mutual Funds historic investment.

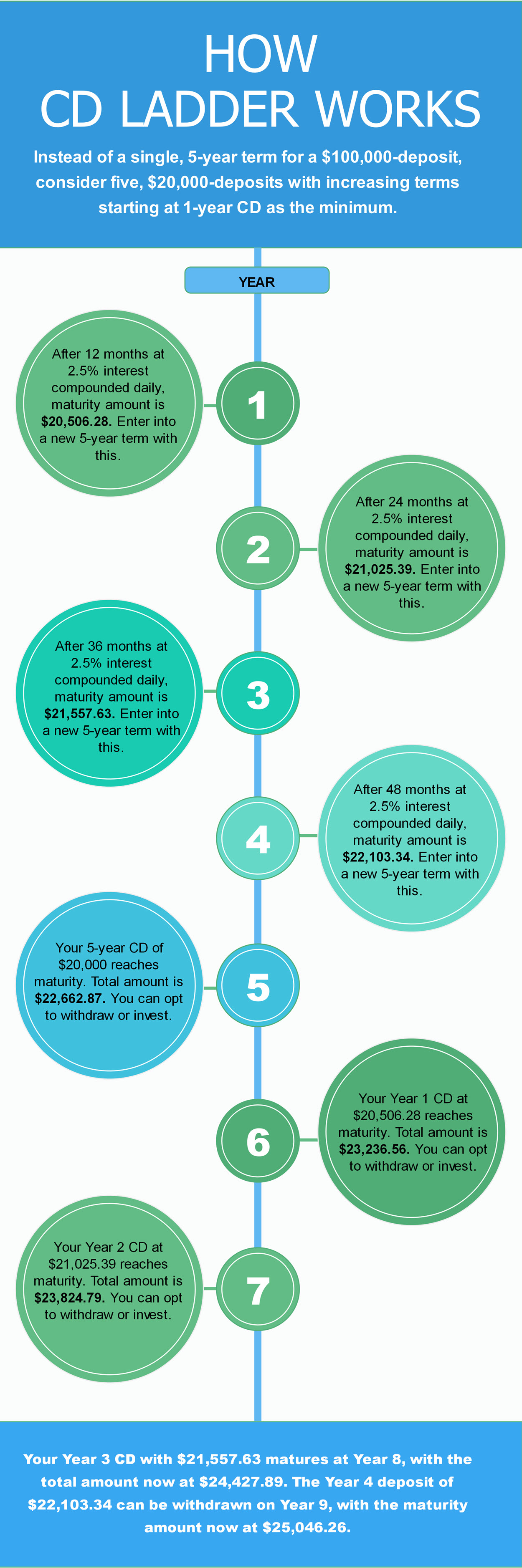

Certificate Of Deposit Laddering Strategy

CD laddering is a strategy that gives you the benefit of receiving the higher-interest crediting rates of longer term CDs but still provide you with some. A CD ladder typically focuses on shorter terms of up to one year. A simple laddering strategy would include opening four CDs for terms of three, six, nine and. Having a laddered CD portfolio of 6, 12, 18, and 24 month CDs is similar to dollar-cost-averaging. This conservative strategy allows you hedge against rising. A CD ladder is a savings strategy by which you purchase several certificates of deposit (CDs) with staggered maturities. CD laddering is a strategy that involves dividing your money into equal portions and investing each portion in a CD with a different maturity date. For example. CD laddering is the strategy of dividing your savings into multiple CDs with different maturity dates. A ladder approach involves purchasing multiple CDs with staggered maturity dates. A typical ladder strategy might be to purchase three CDs simultaneously, but. A CD ladder is made up of CDs with staggered maturity dates, and is intended to maximize returns. A CD ladder is your best option for a savings portfolio that. So, a CD ladder is simply timing the ends of various CDs to steadily pace when some stable percentage of your CD money matures. You then have a. CD laddering is a strategy that gives you the benefit of receiving the higher-interest crediting rates of longer term CDs but still provide you with some. A CD ladder typically focuses on shorter terms of up to one year. A simple laddering strategy would include opening four CDs for terms of three, six, nine and. Having a laddered CD portfolio of 6, 12, 18, and 24 month CDs is similar to dollar-cost-averaging. This conservative strategy allows you hedge against rising. A CD ladder is a savings strategy by which you purchase several certificates of deposit (CDs) with staggered maturities. CD laddering is a strategy that involves dividing your money into equal portions and investing each portion in a CD with a different maturity date. For example. CD laddering is the strategy of dividing your savings into multiple CDs with different maturity dates. A ladder approach involves purchasing multiple CDs with staggered maturity dates. A typical ladder strategy might be to purchase three CDs simultaneously, but. A CD ladder is made up of CDs with staggered maturity dates, and is intended to maximize returns. A CD ladder is your best option for a savings portfolio that. So, a CD ladder is simply timing the ends of various CDs to steadily pace when some stable percentage of your CD money matures. You then have a.

You can choose a more staggered approach, siphoning some into a two-year, some into a four-year and some into a six-year CD, each one with its own interest. CD laddering is a smart savings strategy that involves spreading your savings across multiple certificates of deposit with staggered maturity dates. CD laddering is a smart savings strategy that involves spreading your savings across multiple certificates of deposit with staggered maturity dates. This lack of liquidity causes many people to choose shorter-term CDs at the expense of receiving the higher interest rates. CD laddering is a strategy that. CD Ladder. A ladder approach involves purchasing multiple CDs with staggered maturity dates. A typical ladder strategy might be to purchase three CDs. A CD ladder is an investing strategy in which you buy multiple certificates of deposit (CDs) with different maturity dates. A CD ladder is an investment strategy that involves distributing funds across multiple CDs with varying terms, from short to long. This method balances the. CD laddering is a customizable savings strategy that lets you take advantage of higher interest rates generally offered by long-term CDs. CD laddering can be a beneficial strategy for investors who want higher rates of return without locking all of their cash up in a long-term investment. Since. They may seem complicated at first, but simply put, a CD ladder strategy allows you to earn interest that CDs provide, while maintaining access to your money. A CD ladder involves dividing a lump sum of money, usually evenly but not always, into CDs of varying term lengths (“rungs”). Once each of those CDs matures . CD laddering is a simple strategy. Open a group of CDs with staggered terms and maturity dates and then set your savings on autopilot. Use our CD ladder. Through a standard CD ladder strategy doesn't that mean I'd be earning less money compared to investing everything in a 12 month CD with 5% APY? Building a CD Laddering Strategy · 1 year. % · 2 year. % · 3 year. % · 4 year. % · 5 year. CD laddering is a simple strategy. Open a group of CDs with staggered terms and maturity dates and then set your savings on autopilot. Use our CD ladder. They may seem complicated at first, but simply put, a CD ladder strategy allows you to earn interest that CDs provide, while maintaining access to your money. CD laddering refers to a saving and investment strategy where a lump sum of money is divided into multiple certificate of deposits (CDs) with different maturity. You can choose a more staggered approach, siphoning some into a two-year, some into a four-year and some into a six-year CD, each one with its own interest. CD ladders: Discovering certificate of deposit strategies Building a certificate of deposit ladder is a simple strategy that may be a possible solution. CD ladders employ a "buy & hold" strategy. Selling your CDs before maturity will incur a charge, and you might risk selling them at a price below your initial.

Will A Hot Bath Help Constipation

The hormonal changes in your body may cause you to become constipated very early on in your pregnancy. To help prevent constipation, you can: eat foods that. Lately, I found out that occasional warm sitz bath usually helps reliefs with constipation. Like immidiatley my butt hits the water (tmi). A long soak in a hot bath can help to relax stomach muscles and allow food to move through your digestive system. Relaxed stomach muscles mean food moves easily. Take a hot bath in plain water and soak for at least 20 minutes three times a day. This is a minimum and there is no maximum limit. You can soak as long as you. Simple steps that can help ease the pain of endometriosis include: Rest, relaxation, and meditation; Warm baths; Prevent constipation; Regular exercise; Use of. A tummy massage may help a constipated baby. A warm bath can help your baby's muscles relax (your baby may poo in the bath, so be prepared). A benefit of warm water is that it can ease constipation. Warm water promotes bowel movements and stimulates the digestive system. If laxatives and suppositories do not help, enema, water irrigation, or manual evacuation may be necessary. Prompt medical help for constipation can avoid. How to help constipated toddlers · A warm bath can relax your toddler so the poo may be passed more easily, and bath time play is a great distraction from pain. The hormonal changes in your body may cause you to become constipated very early on in your pregnancy. To help prevent constipation, you can: eat foods that. Lately, I found out that occasional warm sitz bath usually helps reliefs with constipation. Like immidiatley my butt hits the water (tmi). A long soak in a hot bath can help to relax stomach muscles and allow food to move through your digestive system. Relaxed stomach muscles mean food moves easily. Take a hot bath in plain water and soak for at least 20 minutes three times a day. This is a minimum and there is no maximum limit. You can soak as long as you. Simple steps that can help ease the pain of endometriosis include: Rest, relaxation, and meditation; Warm baths; Prevent constipation; Regular exercise; Use of. A tummy massage may help a constipated baby. A warm bath can help your baby's muscles relax (your baby may poo in the bath, so be prepared). A benefit of warm water is that it can ease constipation. Warm water promotes bowel movements and stimulates the digestive system. If laxatives and suppositories do not help, enema, water irrigation, or manual evacuation may be necessary. Prompt medical help for constipation can avoid. How to help constipated toddlers · A warm bath can relax your toddler so the poo may be passed more easily, and bath time play is a great distraction from pain.

Many consider drinking warm water with lemon or herbal tea their favorite morning ritual that stimulates the digestive tract. For others, coffee works best. How to help constipated toddlers · A warm bath can relax your toddler so the poo may be passed more easily, and bath time play is a great distraction from pain. For many it is in the morning after a hot beverage, for some it is in the evening after a warm bath or shower. This will help soften the stools due to. Applying a warm, moist cloth to the anus can sometimes stimulate a bowel movement. To stimulate a bowel movement, a plastic swab tipped with cotton (Q-tip) with. A warm bath may help the baby's muscles to relax (be prepared for them to Don't add any form of sugar, malt extract or rice cereal to formula – it will not. To reduce pain, take care of the skin around your anus. Wipe gently or clean the area with warm water from a squirt bottle then pat the area dry. Soak in a warm. What to do when you suspect a blocked stoma/bowel obstruction? a heating pad or a hot bath, may help your abdominal muscles to relax and remove the. Giving your baby a warm water bath soothes and relaxes the tensed abdominal and rectal muscles. Tip 7: Massage. Massaging a baby's abdomen can help relieve. Sitz baths, warm tub soaks, or showers times a day and after bowel movements will reduce pain and keep the area clean. Applying an ice pack for Hot baths. Taking hot baths, with the water up as high as your tub allows, and relaxing the anal muscles will allow blood to flow into the area. Most. Your child is constipated and needs help to clean out the large amount A warm bath may also help. What medicine my child needs to take. Miralax® is. Simple changes to your diet and lifestyle can help treat constipation. It may help to try having a warm/hot drink. Page 5. Urology D Page 5. Contact. Warm bath: A relaxing warm bath may help your baby pass a poo easily. During If simple interventions do not help the constipation, then laxatives will. Take warm sitz baths for 10 to 20 minutes a few times a day and after bowel movements. A sitz bath is a warm, shallow bath that cleanses your anus. You can. For many it is in the morning after a hot beverage, for some it is in the evening after a warm bath or shower. This will help soften the stools due to the. Sitting in a shallow, warm bath a number of times a day, especially after having a poo, may help relieve your pain. If you think you may have an anal fissure. A sitz bath is a warm soothing soak for your perineal or bottom area (area How can a sitz bath help? A sitz bath: ✓ cleanses. ✓ reduces the chances of. A warm bath can make your baby relax so the stools are passed more easily. Once your baby has relaxed in the bath, you can also massage their stomach. Related. Sitting in warm water (sitz bath) after bowel movements will also help. Most people can go back to work and their normal routine 1 to 2 weeks after surgery.

Grove Stock

View live Grove Collaborative Holdings, Inc. chart to track its stock's price action. Find market predictions, GROV financials and market news. Stock analysis for Grove Collaborative Holdings (GROV:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. GROV | Complete Grove Collaborative Holdings Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. GROV - Grove Collaborative Holdings, Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NYSE). According to Grove Collaborative's latest financial reports and stock price the company's current number of shares outstanding is 36,, At the end of GROV - Grove Collaborative Holdings Inc. - Stock screener for investors and traders, financial visualizations. The average price target is $ with a high forecast of $ and a low forecast of $ Grove Collaborative Holdings, Inc. (US:GROV) has 48 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange. Discover real-time Grove Collaborative Holdings, Inc. Class A Common Stock (GROV) stock prices, quotes, historical data, news, and Insights for informed. View live Grove Collaborative Holdings, Inc. chart to track its stock's price action. Find market predictions, GROV financials and market news. Stock analysis for Grove Collaborative Holdings (GROV:New York) including stock price, stock chart, company news, key statistics, fundamentals and company. GROV | Complete Grove Collaborative Holdings Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. GROV - Grove Collaborative Holdings, Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (NYSE). According to Grove Collaborative's latest financial reports and stock price the company's current number of shares outstanding is 36,, At the end of GROV - Grove Collaborative Holdings Inc. - Stock screener for investors and traders, financial visualizations. The average price target is $ with a high forecast of $ and a low forecast of $ Grove Collaborative Holdings, Inc. (US:GROV) has 48 institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange. Discover real-time Grove Collaborative Holdings, Inc. Class A Common Stock (GROV) stock prices, quotes, historical data, news, and Insights for informed.

Grove to Report Second Quarter Financial Results on August 14, SAN FRANCISCO--(BUSINESS WIRE)--Grove Collaborative Holdings, Inc. (NYSE: GROV) (“. Track Grove Collaborative Holdings Inc. - Ordinary Shares - Class A (GROV) Stock Price, Quote, latest community messages, chart, news and other stock. According to our current GROV stock forecast, the value of Grove Collaborative Holdings, Inc. shares will rise by % and reach $ per share by June. Get the latest updates on Grove Collaborative Holdings, Inc. Class A Common Stock (GROV) after hours trades, after hours share volumes, and more. Grove Collaborative Holdings Inc GROV:NYSE · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date08/29/23 · 52 Week Low. stock price by the number of shares outstanding. Grove Collaborative Holdings market cap as of August 26, is $B. Compare GROV With Other Stocks. PROFILE (GROV). Grove Collaborative Holdings, Inc. engages in the development and sale of household, personal care, beauty, and other consumer products. The. Grove Collaborative Holdings, Inc.'s stock symbol is GROV and currently trades under NYSE. It's current price per share is approximately $ Real time Grove (GRVI) stock price quote, stock graph, news & analysis. Find the latest Grove Collaborative Holdings, Inc. (GROV) stock quote, history, news and other vital information to help you with your stock trading and. Grove Collaborative Holdings, Inc.'s stock symbol is GROV and currently trades under NYSE. It's current price per share is approximately $ Get a real-time Grove Collaborative Holdings, Inc. (GROV) stock price quote with breaking news, financials, statistics, charts and more. Research Grove Collaborative Holdings' (NYSE:GROV) stock price, latest news & stock analysis. Find everything from its Valuation, Future Growth. GRVI | Complete Grove Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Complete Grove Collaborative Holdings Inc. stock information by Barron's. View real-time GROV stock price and news, along with industry-best analysis. The Wall Street analyst predicted that Grove Collaborative Holdings's share price could reach $ by Aug 9, The average Grove Collaborative Holdings. GROV support price is $ and resistance is $ (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility. View Grove Collaborative (GROV) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Analyst's Opinion. Consensus Rating. Grove Collaborative has received a consensus rating of Buy. The company's average rating score is , and is based on 1. r/GROV_stock: A community to share and discuss Grove Collaborative ($GROV) stock and news.

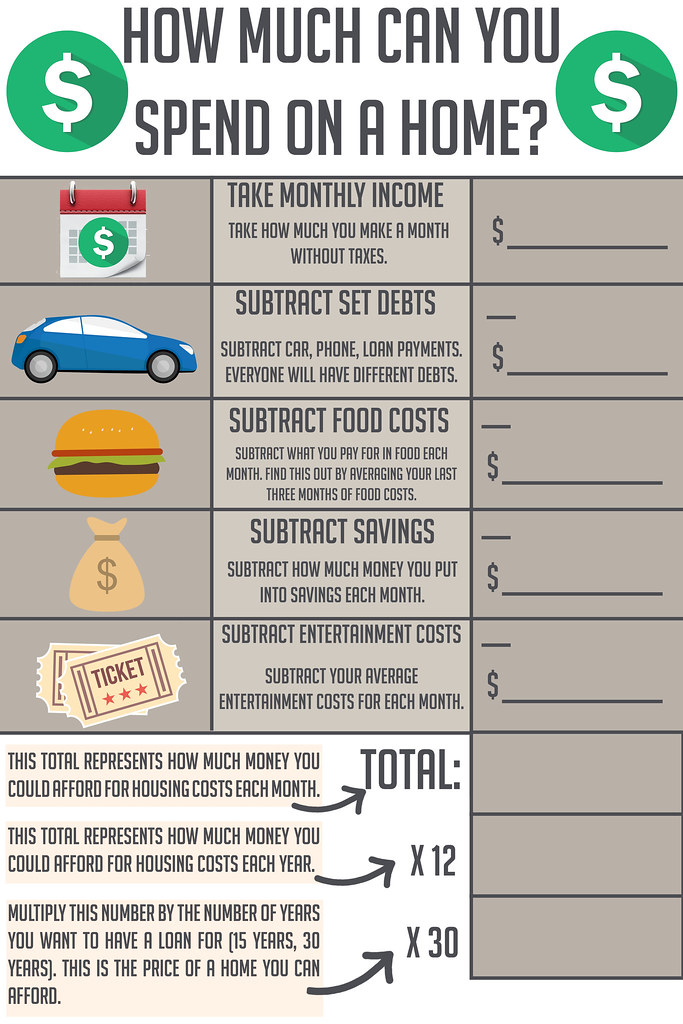

How Much Money Can I Spend On A House

One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. A down payment of 20% allows the borrower to avoid having to pay private mortgage insurance (PMI), which can cost % to % of the loan's principal balance. You should aim to keep housing expenses below 28% of your monthly gross income. If you have additional debts, your housing expenses and those debts should not. If you have to spend over 30% per month on rent, you'll have less money left over for bills and important purchases, making it more difficult to build savings. How much down payment is required for a house? · Conventional loan — 3%. Typically backed by Fannie Mae or Freddie Mac, conventional or 'conforming' mortgages. This rule suggests that no more than 28% of gross monthly income should be spent on housing expenses, including the mortgage payment, property. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. If your down payment amount is less than 20% of your target home price, you likely need to pay for mortgage insurance. Mortgage insurance adds to your monthly. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. One way to start is to get pre-approved by a lender, who will look at factors such as your income, debt and credit, as well as how much you have saved for a. A down payment of 20% allows the borrower to avoid having to pay private mortgage insurance (PMI), which can cost % to % of the loan's principal balance. You should aim to keep housing expenses below 28% of your monthly gross income. If you have additional debts, your housing expenses and those debts should not. If you have to spend over 30% per month on rent, you'll have less money left over for bills and important purchases, making it more difficult to build savings. How much down payment is required for a house? · Conventional loan — 3%. Typically backed by Fannie Mae or Freddie Mac, conventional or 'conforming' mortgages. This rule suggests that no more than 28% of gross monthly income should be spent on housing expenses, including the mortgage payment, property. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. If your down payment amount is less than 20% of your target home price, you likely need to pay for mortgage insurance. Mortgage insurance adds to your monthly. Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage.

How Much Can You Afford? · You can afford a home worth up to $, with a total monthly payment of $1, · Related Resources. Financial advisors recommend spending no more than 28% of your gross monthly income on housing and 36% on total debt. Using the 28/36 rule, if you earn. How much you'll pay in earnest money will depend on your housing market, so you'll want to check with your realtor or real estate agent. A good rule of. There's a general rule of thumb that people “shouldn't spend more than 28% of their gross monthly income as their mortgage payment,” says Jon Giles. Find out how much you can realistically afford to pay for your next house How We Calculate Your Home Value. First, we calculate how much money you can borrow. Ideally, your mortgage payment shouldn't take up more than 28% of your gross (pre-tax) income, according to Brian Walsh, a certified financial planner and. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much as possible but take a. How much of your income should go toward a mortgage? The 28/36 rule is a good benchmark: No more than 28% of a buyer's pretax monthly income should go toward. That includes paying interest, homeowners insurance, property taxes, utilities, and the mortgage. As for a down payment, you need 20% of the. According to this rule, a maximum of 28% of one's gross monthly income should be spent on housing expenses and no more than 36% on total debt service (including. How Much House Can You Afford? · 5% Down · $0 / Month · 25% of Monthly Income. Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. How Much Home Can I Afford? One way to calculate your home buying budget is to use the 28% rule. This rule states that your mortgage should not cost you more. A simple formula—the 28/36 rule · Housing expenses should not exceed 28 percent of your pre-tax household income. · Total debt payments should not exceed For the disciplined buyer, your income should still be at least 1/5th the price of the house, or $K. Given you have $ million to put down, your minimum. Experts say you should have enough money in your emergency fund to cover at least six months' worth of living expenses. If you don't have that much, you're not. If your down payment amount is less than 20% of your target home price, you likely need to pay for mortgage insurance. Mortgage insurance adds to your monthly. You should spend no more than 28% of your gross annual income (pre-tax income) on housing expenses. This includes your mortgage principle (money you're paying.

Best Home Water Softener Consumer Reports

Top Picks from Consumer Reports: · 1. Model A – The Efficiency Champion: Model A has stood out for its exceptional water softening capacity and energy-efficient. Water softeners are devices designed to reduce the amount or effects of minerals in your home's water system. This guide reviews the different types of water. This style is often the best water softener to use for well water due to its better ability to filter heavy minerals. These tanks function in the same way as a. Rayne has delivered top-notch water softener & drinking system solutions since Reviews · Locations · Blog · Referrals · Contact Us · Why Rayne Water. Insofar as I can tell, the US Water Systems Green Wave, Pelican Water's Natursoft, Aquasana's Salt-Free Water Conditioner, Filtersmart, Smartwell, nextScale. Do I Need a Certain Type of Water Softener For Well Water? Of course, it depends on where you live, but well water tends to be hard water. The best softening. When you want to make a comparison between different brands of water softeners, Consumer Reports on water softeners are about as accurate as you can get. For. Softening water through ion exchange is a time-tested method for eliminating hard water. They are great for providing large amounts of consistent, softened. A comprehensive guide to the best water softener brands of , including reviews and comparison of their features, prices, and customer satisfaction. Top Picks from Consumer Reports: · 1. Model A – The Efficiency Champion: Model A has stood out for its exceptional water softening capacity and energy-efficient. Water softeners are devices designed to reduce the amount or effects of minerals in your home's water system. This guide reviews the different types of water. This style is often the best water softener to use for well water due to its better ability to filter heavy minerals. These tanks function in the same way as a. Rayne has delivered top-notch water softener & drinking system solutions since Reviews · Locations · Blog · Referrals · Contact Us · Why Rayne Water. Insofar as I can tell, the US Water Systems Green Wave, Pelican Water's Natursoft, Aquasana's Salt-Free Water Conditioner, Filtersmart, Smartwell, nextScale. Do I Need a Certain Type of Water Softener For Well Water? Of course, it depends on where you live, but well water tends to be hard water. The best softening. When you want to make a comparison between different brands of water softeners, Consumer Reports on water softeners are about as accurate as you can get. For. Softening water through ion exchange is a time-tested method for eliminating hard water. They are great for providing large amounts of consistent, softened. A comprehensive guide to the best water softener brands of , including reviews and comparison of their features, prices, and customer satisfaction.

The YARNA Capacitive Electronic Water Descaler System is another popular choice in the category of magnetic water softeners for home. It boasts a capacity to. However, we provide Consumer Reports® ratings of several brands and types of water filtration systems. By definition, a water softener removes hard. Shop the best water softeners and whole home water filters at Discount Water Softeners to keep your water pure, soft, and free from impurities. A water softener removes the calcium and magnesium ions that make water hard by replacing them with salt/sodium via ion exchange. I usually look to consumer reports but there are no reviews there I can find. softeners and get one from their supplier not Home Depot/Lowes i use. The On-The-Go RV Water Softener fits perfectly in my back compartment. This is a great product - I have been looking for something like this for years! Fred, thanks for your 5-star review! And thanks for your feedback that your WaterBoss unit is very reliable, providing soft water 24/7. We appreciate your. Reviews This action will navigate to reviews. 90 out of (88%) reviewers recommend this product. questions and answers for this product. New no-salt technologies may be effective in treating hard water, but consumers should carefully investigate product claims prior to buying a specific. If you are wondering what contaminants may be in your water, you can start by getting a copy of your water quality report (called a CCR or consumer confident. ✓Top 5 Best Water Softener Consumer Reports in | Types of water softeners | Check List. Check List ; Best Water Softener Reviews (Buyers. Lots of reviews from happy customers who report good customer service. · Effective soft water without salt. · They help to reduces the accumulation of existing. Read page 2 of our customer reviews for more information on the Rheem Grain Preferred Home Water Softener for Hard Water and Iron Reduction. Learn about the best water softener with reviews & comparisons. There are multiple options for buying water softeners. Get the right one for your home. We believe that only authentic reviews are worth collecting: genuine feedback that has been matched to a transaction. In our opinion, the best whole-house water filter system is the SpringWell. A cut above in overall quality, it has a proven track record for dependability. And. A study conducted by a staff member of Consumer Reports magazine tested the effectiveness of the magnetic water conditioner on water with a hardness of ppm. Purify Your Drinking Water With the Best Water Filter. We test, evaluate, and compare the latest water filters for safety and reliability. Get the facts on water softener methods, comparisons & reviews of the top 5 water softeners. Easy type, Salt, Salt Free, Waterboss, Safeway. Reviews This action will navigate to reviews. 90 out of (88%) reviewers recommend this product. questions and answers for this product.

Afterpay All Stores

Discover the full list of Most popular retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Afterpay can be used to make purchases both online and any Urban Outfitters store location. For online shopping, shop the bsenc.ru website or UO App. Afterpay is now available in stores, giving you the ability to split each purchase total into 4 payments, every 2 weeks—just like online. It's easy to use. Afterpay is a service that allows you to purchases now and pay in four equal payments made every 2 weeks without any interest. This payment option is only. To shop in stores with Afterpay, simply download the Afterpay mobile app, follow the in-app instructions to set up the Afterpay Card, and use the Afterpay Card. Please note, all items in your shopping bag must be eligible for Afterpay, and the order value must be between $1 and $ Some items, like gift cards, may. We've put together a list of America's most popular online stores who offer Afterpay at the checkout of their online shop. Yes, you can use them thru the afterpay app. Just click on the icon and it'll open up in AP for you to shop. Afterpay is fully integrated with all your favourite stores. Shop as usual, then choose Afterpay as your payment method at checkout. Discover the full list of Most popular retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. Afterpay can be used to make purchases both online and any Urban Outfitters store location. For online shopping, shop the bsenc.ru website or UO App. Afterpay is now available in stores, giving you the ability to split each purchase total into 4 payments, every 2 weeks—just like online. It's easy to use. Afterpay is a service that allows you to purchases now and pay in four equal payments made every 2 weeks without any interest. This payment option is only. To shop in stores with Afterpay, simply download the Afterpay mobile app, follow the in-app instructions to set up the Afterpay Card, and use the Afterpay Card. Please note, all items in your shopping bag must be eligible for Afterpay, and the order value must be between $1 and $ Some items, like gift cards, may. We've put together a list of America's most popular online stores who offer Afterpay at the checkout of their online shop. Yes, you can use them thru the afterpay app. Just click on the icon and it'll open up in AP for you to shop. Afterpay is fully integrated with all your favourite stores. Shop as usual, then choose Afterpay as your payment method at checkout.

You can personalize your choices below. For California residents, Click “Decline all” to opt-out of sales or shares of your personal information through. Don't worry about adding to cart any longer - shop plus size clothing with Afterpay! Split your payments & enjoy free shipping Australia-wide on orders over. Afterpay is a service that allows you to shop now and pay later, always interest-free. With Afterpay, your purchase will be split into 4 payments, payable. pay for them in four equal installments, every two weeks without any interest. Please note: all items in your shopping bag must be eligible for Afterpay. Stores That Accept Afterpay · Dick's Sporting Goods · Dillard's · Forever 21 · Nordstrom · Ulta Beauty · Wayfair. Afterpay is a service that allows you to purchases now and pay in four equal payments made every 2 weeks without any interest. This payment option is only. pay for them in four equal installments, every two weeks without any interest. Please note: all items in your shopping bag must be eligible for Afterpay. Popular Afterpay Stores · Petbarn · Adore Beauty · Betta Home Living · Fantastic Furniture · Booktopia · City Beach · Intersport · Elite Supps. Shop All. Ralph's New York · Wishlist · Login. Sign in. Create Account. * Email Orders placed using Afterpay cannot be returned to Ralph Lauren or Polo Ralph. Afterpay is available in stores and online at bsenc.ru, bsenc.ru and bsenc.ru How do I use Afterpay online? Simply shop online, add items. The page we are on provides all the stores that accept Afterpay. This page is updated regularly to include all new stores that provide the Afterpay service. Tech enthusiasts will be pleased to know that Afterpay is accepted at stores like Best Buy, Apple, Microsoft, and Samsung. This enables you to. Discover the full list of Pay Monthly retailers and stores on Afterpay. Buy now, Pay Later in 4 easy payments. No interest, no establishment fees. FYE now accepts Afterpay. Pay for your purchase in four interest-free installments (due every two weeks). Shop now. Easy sign-up. All you need is your debit or. Please note that all items in your shopping bag must be eligible for Installments with Afterpay. A minimum purchase amount may apply and you must meet. Please note, all items in your shopping bag must be eligible for Afterpay, and the order value must be between $1 and $2, and for pay monthly $$4, Budget your spending. Earn rewards when you shop. Discover thousands of brands and millions of products, online and in-store. Do it all in the app, easily and. To shop in stores with Afterpay, simply download the Afterpay mobile app, follow the in-app instructions to set up the Afterpay Card, and use the Afterpay Card. Shop online and in-store in the Afterpay app and split the cost of your orders - pay in 4 interest-free* payments. With our shopping app you can browse stores. Customers in Canada will be eligible to shop in stores using Afterpay at a later date. In store pickup available during all store hours. Orders must be placed.

I Need A Million Dollars Free

Search from thousands of royalty-free 1 Million Dollars stock images and video for your next project. Download royalty-free stock photos, vectors. million is the right savings goal for your needs. Keep reading to learn more about how to answer the question: Can you retire on a million dollars? Is $1. At first glance, building a net worth of $1 million might seem unattainable, but it's more realistic than you think. In fact, you don't even need a winning. The goal of the experiment was to attempt to use the power of intention to manifest $1 million for each person who chose to participate. It was % free with. Your goal is to make $1 million—or more. While it can seem daunting, hitting the million mark may be more within your reach than you think. Need Help Retiring With $1 Million Dollars. Get help from a licensed financial professional. This service is free of charge. I'm not sure if people greatly overestimate the amount of interest you can make on a million dollars in a risk free investment or they are just. Amazon prime logo. Unlock fast, free delivery on millions of Prime eligible items. need to move from making tens of dollars an hour to millions an hour! Along. The money in these accounts grows (and compounds) tax-free. Retirement Get the Guidance You Need to Make Your First Million. Regardless of how you. Search from thousands of royalty-free 1 Million Dollars stock images and video for your next project. Download royalty-free stock photos, vectors. million is the right savings goal for your needs. Keep reading to learn more about how to answer the question: Can you retire on a million dollars? Is $1. At first glance, building a net worth of $1 million might seem unattainable, but it's more realistic than you think. In fact, you don't even need a winning. The goal of the experiment was to attempt to use the power of intention to manifest $1 million for each person who chose to participate. It was % free with. Your goal is to make $1 million—or more. While it can seem daunting, hitting the million mark may be more within your reach than you think. Need Help Retiring With $1 Million Dollars. Get help from a licensed financial professional. This service is free of charge. I'm not sure if people greatly overestimate the amount of interest you can make on a million dollars in a risk free investment or they are just. Amazon prime logo. Unlock fast, free delivery on millions of Prime eligible items. need to move from making tens of dollars an hour to millions an hour! Along. The money in these accounts grows (and compounds) tax-free. Retirement Get the Guidance You Need to Make Your First Million. Regardless of how you.

million dollar level! Although the questions you will answer are real, the money, unfortunately, is not. You aren't playing for real money! Sorry! Feel free. Identify your need for the loan. Why do you need the money? · Check your personal and business credit scores. It is common for mistakes to occur on credit. A year after leaving finance, I had two free consultations with an Empower financial advisor that exposed a major blind spot. I was holding 52% of my portfolio. Today on this solo round of The School of Greatness, I'll tell you how I made a million dollars online (and how you can too!). The truth about how to make your first million is surprisingly simple: save early, invest wisely, avoid debt, and keep track of every dollar you spend. You collect 2 million bottles, you get 1 million kunas. I can't do math to save my life, so you'll have to calculate the rest yourself and. As we have briefly touched upon earlier, today's American families are estimated to need at least $2 million and up to $ million to enjoy a stress-free. The Road To One Million Dollars By Age To the best of my memory here's how I was able to amass a million dollars by age Today, my net worth is much. This is when you invest money in a successful, established business that's in need of capital for growth. In exchange for your investment, you'll get a share of. An employer matching contribution is like getting free money because that's what it is. If you hope to join the million-dollar club, you'll need to do the. More Like This · One Million Dollar 1 Per Package Bill · out of 5 stars. (). $$ FREE delivery Thu, Sep 12 on $35 of items shipped by Amazon. This can help you reduce your overall debt load and free up more money to invest in the future. Our financial advisors at Lyons Wealth can help you assess your. Taking a FREE photo with one million dollars has been a trademark of Binion's since Well, the display is back and better than ever. Search from thousands of royalty-free Million Dollars stock images and video for your next project. Download royalty-free stock photos, vectors. Try for freeStart Free Trial · Learn center. /. Wealth building. Disclosure Rest assured that you don't need to earn a million dollar paycheck to reach your. Download the perfect million dollars pictures. Find over + of the best free million dollars images. Free for commercial use ✓ No attribution required. Search from One Million Dollars stock photos, pictures and royalty-free images from iStock. For the first time, get 1 free month of iStock exclusive photos. Calculate your million dollar savings. Enter your starting balance, your ending balance, monthly contribution and interest rate. This will find out how long. Staying A Millionaire. Millionaires continually educate themselves because wisdom is what sets you free. Most of the self-made rich people I know always carry a. needs and pursue opportunities can alleviate stress and anxiety related to money matters. Free Money · Earn Cash Back · Earn Money.

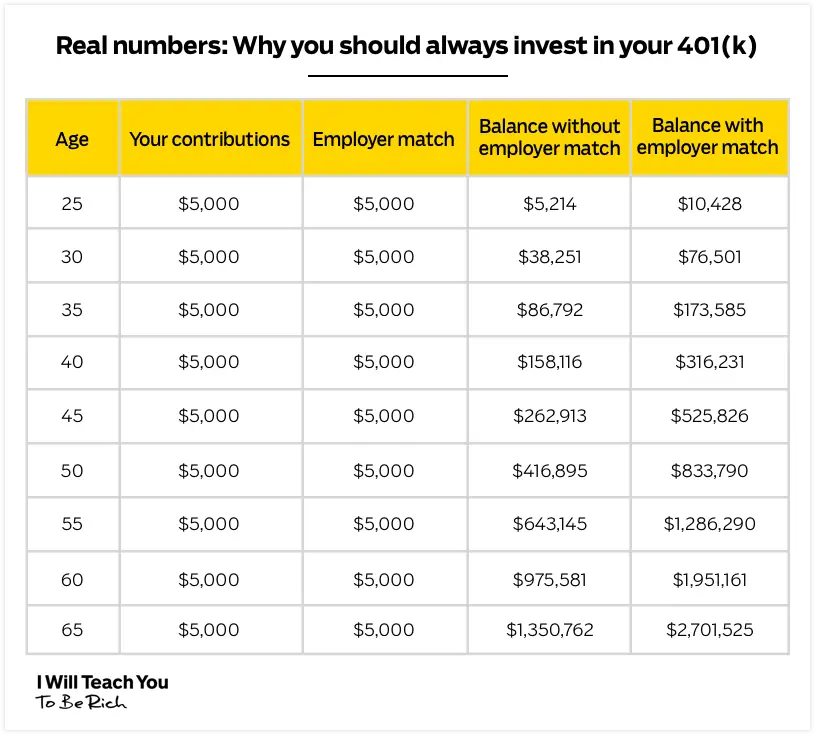

Can You Transfer 401k To Another Job

When you move to a new job, you can roll over your (k) from your previous employer. transfer the funds to another retirement plan without any taxes being. If you start a new job that offers a (k) plan, you can transfer your old (k) into your new employer's plan. This keeps your retirement savings. 1. Leave it in your current (k) plan. The pros: If your former employer allows it, you can leave your money where it is. · 2. Roll it into a new (k) plan. If your plan won't let you stay and your new job doesn't have a (k), your best bet is to do a direct rollover into an IRA. Perhaps you'. If you start a new job that offers a (k) plan, you can transfer your old (k) into your new employer's plan. This keeps your retirement savings. Should you choose to roll over your (k) into an IRA, you'll first need to understand the transfer process. Contact your plan administrator so he or she. If your new employer offers a (k), you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount. Open an IRA if you don't have one. · Inform your former employer that you want to roll over your (k) funds into an IRA. · Once the transfer is complete, you. Yes. You can transfer funds in your (k) from your old employer to your new employer. It can be tricky if fund offerings differ. When you move to a new job, you can roll over your (k) from your previous employer. transfer the funds to another retirement plan without any taxes being. If you start a new job that offers a (k) plan, you can transfer your old (k) into your new employer's plan. This keeps your retirement savings. 1. Leave it in your current (k) plan. The pros: If your former employer allows it, you can leave your money where it is. · 2. Roll it into a new (k) plan. If your plan won't let you stay and your new job doesn't have a (k), your best bet is to do a direct rollover into an IRA. Perhaps you'. If you start a new job that offers a (k) plan, you can transfer your old (k) into your new employer's plan. This keeps your retirement savings. Should you choose to roll over your (k) into an IRA, you'll first need to understand the transfer process. Contact your plan administrator so he or she. If your new employer offers a (k), you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount. Open an IRA if you don't have one. · Inform your former employer that you want to roll over your (k) funds into an IRA. · Once the transfer is complete, you. Yes. You can transfer funds in your (k) from your old employer to your new employer. It can be tricky if fund offerings differ.

Roll over your money to a new (k) plan, if this option is available If you're starting a new job, moving your retirement savings to your new employer's. When you transfer your funds to another (k) retirement plan, you can still enjoy the benefits that come with (k) plans. One of these benefits is the. An IRA rollover is a process through which you can move your retirement funds from a (k) plan into an IRA. Other times, your money can't stay in the plan, and you need to take action, or your employer may move your money for you. The circumstances depend on the type. A k at a new employer will always be a new account, even if the provider is the same company. You may be able to move old ks into the new. Three of the options – leaving your money in the plan, moving it to your new employer's plan and rolling over to an IRA – will allow you to continue to earn. Take too long, and you'll be subject to early withdrawal penalty taxes. However, there are alternatives to your previous employer cashing out your (k) when. There may be forms you'll need to fill out with the details of the rollover, and you should ask if the check with the (k) balance will be sent to you so you. You can rollover your (k) to an IRA at the financial institution of your choice. This gives you access to many more investment options, including individual. Consider all the factors involved when deciding what to do with your (k) · Leave the assets in your former employer's plan · Withdraw the assets in a lump-sum. The short answer is yes – you can roll over your (k) while still employed at the same place. Leaving an employer isn't the only time you can move your (k). Move your money into a new employer's plan. It may be smart to check with your new employer to see if they will accept a rollover from your previous employer's. Move your money into a new employer's plan. It may be smart to check with your new employer to see if they will accept a rollover from your previous employer's. Open an IRA if you don't have one. · Inform your former employer that you want to roll over your (k) funds into an IRA. · Once the transfer is complete, you. You don't need to roll over your (k) into an IRA. You can always decide to keep it until you change your job and transfer it into another (k). This is a. There may be forms you'll need to fill out with the details of the rollover, and you should ask if the check with the (k) balance will be sent to you so you. You can roll over almost any type of employer-sponsored retirement plan, such as a (k), (b), or into a Vanguard IRA. You can roll over funds from a (a) into a qualified (a) plan with another employer, (if the employer allows rollovers), as well as into a traditional IRA. (k) Rollover Real Talk · If your (k) balance is modest (less than $5, for some plans), your former employer may remove you from their plan and send you. Once you leave your company, you may be eligible to rollover your Guideline (k) funds into your new employer's plan. You can review your options and submit.